This part mainly talks about the industry situation of spandex, one of the main products of Taihe New Materials.

The main products of Taihe New Materials include spandex and aramid. According to the company’s disclosure, its production capacity ranks among the top five in the spandex industry, and it is a leading domestic enterprise in the aramid industry.

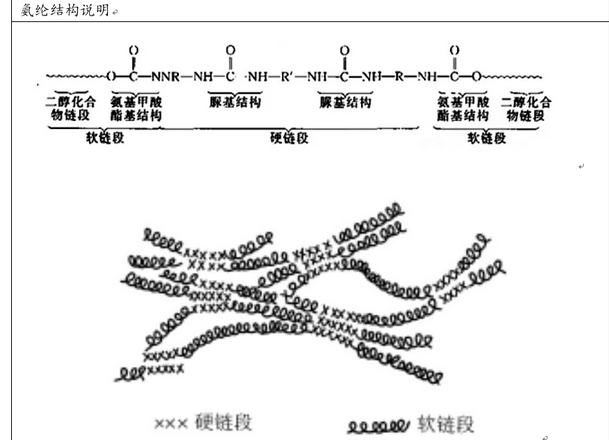

Spandex is a chemical fiber with excellent elasticity. Spandex is the abbreviation of polyurethane (PU) fiber, and spandex is collectively referred to as Spandex fiber internationally. The molecular chain of spandex is a long chain of alternating soft and hard polyurethane block copolymers. The “hard segment” is formed by the reaction of diisocyanate and small molecule polyol or polyamine chain extender. It has a higher melting point; low molecular weight The flexible chains of polyester or polyether polyols form “soft segments” with lower melting points. The “soft segment” is easily elongated and deformed under the action of external force, while the “hard segment” serves as a physical cross-linking point to prevent molecular chain slippage and gives the fiber resilience after stretching. The special molecular structure of alternating soft and hard blocks makes spandex have excellent elasticity and recovery rate. The elongation at break of spandex is greater than 400%, usually 500-700%, up to 800%, when stretched by 300%. The elastic recovery rate can reach more than 95%.

Spandex is a “MSG-type” fabric that can greatly improve the performance of textile fabrics. The upstream raw materials of spandex are mainly chemical materials. Downstream, they are made into coated sand, core-spun yarn, twisted yarn and other forms together with other fibers, and then processed and manufactured on warp knitting, weft knitting, weaving and other equipment, and finally used in In the field of textile and garment industry and industrial textiles, generally only a small amount of spandex (usually between 3% and 20%) needs to be added to textiles to make the fabrics soft, comfortable and beautiful. Spandex can also be used in professional swimming trunks, swimsuits, protective clothing and other clothing fields that require high comfort and stretchability.

Different application scenarios of spandex depend on its fineness. Fineness is generally used to measure the thickness of spandex fiber. The measure of fineness is the number of grams of weight at a common moisture regain. There are two units: dtex, which refers to the number of grams of the weight of a 10,000-meter-long fiber at a common moisture regain, and Denier, which refers to the number of grams of a 9,000-meter-long fiber at a common moisture regain. .

The fineness of spandex yarn can range from 11dtex to 3750dtex, among which 20D, 30D, 40D, 70D and 140D are more commonly used. Usually spandex is mostly 40D; in recent years, the demand for fine denier yarns such as 20D and 30D has grown rapidly and can be widely used in underwear and socks; 140D thick denier yarns are used in lace, ribbons, sock tops and other fields, and can also be used Elastic tie on the ear straps of the mask and protective clothing.

The textile field is the main application of spandex products, and spandex is used in a large number of textiles. According to data from Zhuochuang Information, 30% of spandex is used in knitted underwear and socks, and 30% is used in sportswear, swimsuits and tights. The rapid growth of sportswear in the past two years has brought stable downstream demand for spandex. application.

According to industry data from the China Chemical Fiber Association, the spandex industry is already a very mature industry with stable overall demand. In 2021, the apparent consumption of spandex in my country (due to the wide range of downstream application fields of the spandex industry, it is difficult to count the real consumption, so the apparent consumption is used to estimate the overall consumption, the difference is not big, the apparent consumption is the output + net import) was 783,400 tons, a year-on-year increase of 9.21%, mainly driven by the impact of the epidemic and the demand for protective spandex and sports, home, bedding, warmth and other products. As of August 2022, my country’s apparent consumption of spandex is 509,000 tons.

According to CITIC Securities’ forecast, my country’s demand for spandex will maintain a growth rate of around 10% in the next few years, and the overall demand is expected to be 1.3 million tons by 2025.

However, in terms of supply, the total domestic spandex production capacity will be approximately 970,000 tons by the end of 2021, and the supply capacity is much greater than the current demand for spandex. Therefore, competition in the spandex industry will focus on cost leadership and differentiated products. The tendency of business concentration.

Although the overall spandex industry has been experiencing oversupply in the past two years, spandex production capacity has been gradually growing. Domestic spandex production capacity accounts for more than 70% of the world’s. At the same time, the number of spandex manufacturers is gradually decreasing, which also shows that the introduction of backward production capacity and the commissioning of advanced production capacity coexist in the industry. Taihe New Material’s nominal spandex production capacity at the end of 2021 is at the level of 75,000 tons, accounting for about 6% of the industry’s production capacity and 7.7% of its domestic production capacity.

The top five domestic spandex manufacturers are Huafeng Chemical, Hyosung Spandex, Xinxiang Chemical Fiber, Zhuji Huahai and Taihe New Materials.

According to the disclosures of listed companies such as Huafeng Chemical and Xinxiang Chemical Fiber, and with reference to the research report of CITIC Securities, the approximate domestic spandex production capacity distribution is as shown in the table above. Huafeng Chemical basically accounts for 1/4 of the domestic production capacity, and Taihe New Materials Ranking fifth in overall production capacity, it has certain competitiveness in the spandex industry. At the same time, in recent years, due to competitive pressure and environmental protection pressure in the spandex industry, many backward production capacities have withdrawn, and leading companies have made great efforts to expand production. Companies including Taihe New Materials have plans to expand new spandex production capacity.

The price of spandex has fluctuated greatly in recent years, especially during the period when the price of spandex dropped, which affected the overall operating rate of the industry and thus the profitability of spandex companies. Spandex price in 2020The quarter began to rebound, driven by rising raw material prices and a significant rebound in downstream demand. Since 2021, increased demand in the fields of masks, protective clothing, etc. has caused the spandex market price to rise to a maximum of 80,000 yuan per ton, and the profitability of industry companies has increased significantly. promote. However, with the commissioning of new production capacity and the recovery of operating rates in the second half of 2021, the overall spandex price has begun to decline.

According to the latest data update from Baichuan Yingfu, the price of spandex is gradually stabilizing. However, the operating rate of the overall industry is still around 60%, which has affected the overall profitability of industry companies. However, the recent profit of spandex has dropped to a low point. With the recovery of downstream demand, the profit of spandex is expected to rebound.

Finally, let’s take a look at the operating income growth and profit changes of the leading domestic spandex companies in the past two years.

The overall gross profit margin changes of the leading companies in the spandex industry are basically the same, the unit prices of the products are also basically the same, and the industry growth rate is basically consistent after excluding the impact of production capacity. The profitability of the leading company Huafeng Chemical is obviously higher, which also reflects that Huafeng Chemical is ahead of other companies in terms of cost control. Since the sales volume of Xinxiang Chemical Fiber from 2017 to 2019 refers to production volume, the unit price is slightly lower than that of Huafeng Chemical. Due to the conversion of old and new production capacity in 2018 and 2019, Taihe New Materials has affected the overall gross profit margin level. In other years, the gross profit margin of Taihe New Materials is basically the same as that of Xinxiang Chemical Fiber. The operating income and profit changes of leading companies are basically consistent with the changes in supply and demand of the spandex industry and the changes in spandex prices. The leading companies still have an absolute crushing advantage in terms of cost advantage. It is worth mentioning that Huafeng Chemical was still a company with spandex as its main business before 2018. Now it has gradually expanded into other products. It is considered a very excellent chemical product company and deserves attention.

Compared with Huafeng Chemical, Taihe New Materials still has a considerable gap, so the subsequent low-cost layout in Ningxia and the layout of differentiated spandex products still need to be improved accordingly to enhance its competitiveness. However, compared with other manufacturers with smaller production capacity, Xinxiang Chemical Fiber and Taihe New Materials are expected to have comparative advantages.